“Did You Know” Series | 2023 RWI Claims Reports and Analysis

Written by Tray Traynor, Partner

We are pleased to present the next iteration of SSP’s Did You Know series, our annual Claims Report edition. Three prominent RWI markets (AIG, Liberty, and Euclid), recently released their respective versions of a RWI claims report.

These are excellent, data-heavy reports. Congratulations to these markets for their great work. Each report can be found at the respective link: AIG, Liberty, Euclid.

Instead of simply linking the reports, SSP has analyzed each one in detail and provided a thorough summary of the collective key takeaways per category in order to facilitate efficient consumption of the data. The categories we focused on are Claim Distribution, Claim Frequency, Breach Type, Claim Severity, and Claim Reporting. All data herein is the property of each carrier respectively.

What has your experience been with RWI claims? We always appreciate conversation around claims, whether good, bad, or ugly, and would love to hear your feedback.

The 8 Most Important Takeaways

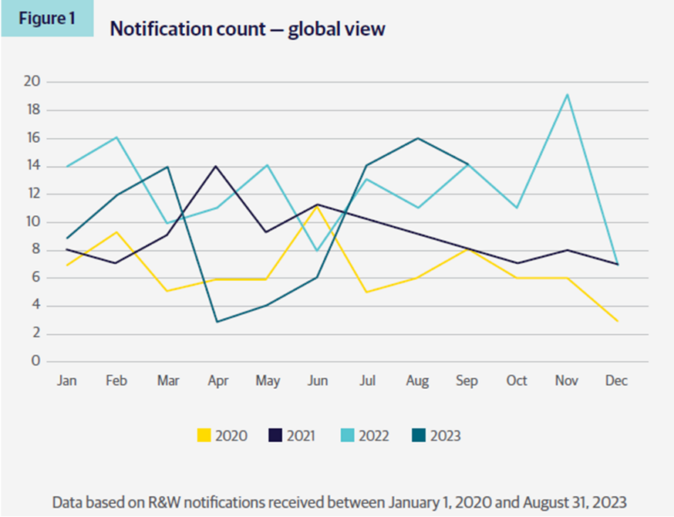

- The predicted uptick in RWI claim notifications based on the heightened M&A activity of 2021 and early 2022 has arrived for pockets of the market. Liberty reported a 38% increase in claim notifications received in 2022. However, that trend is expected to subside going forward commensurate with the market slowdown in the M&A market from mid 2022 thru 2023.

- Claims with medium-severity ($1M – $10M) and high-severity ($10M+) payouts are also on the rise.

- A higher percent of claims made are resulting in actual losses. This trend is expected to continue due to the significant decrease in retention level for policies written in 2023.

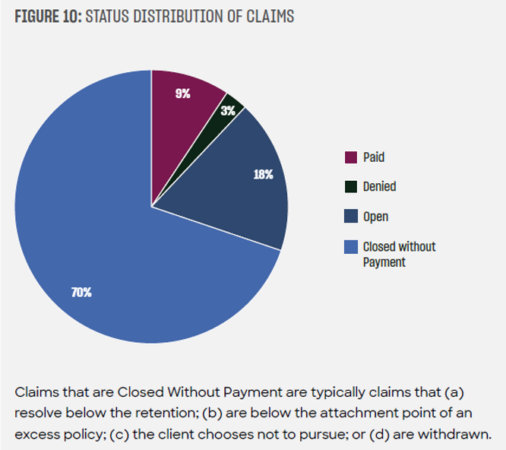

- Outright claim denials are rare. According to Euclid, since 2016, only 3% of claims have been denied and only .5% have resulted in arbitration or litigation.

- Financial Statements, Tax, Customer Contracts, Compliance with Laws, and Employee-Related claims continue to be the most common areas of claim notifications.

- Claims for breaches of Financial Statement and Customer Contracts continue to be two main drivers of claim severity, in addition to claim frequency.

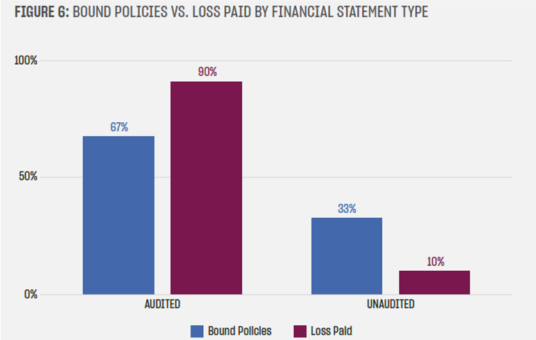

- Though counterintuitive, claims for breach of Financial Statement reps on audited target companies are received at a higher rate than unaudited target companies.

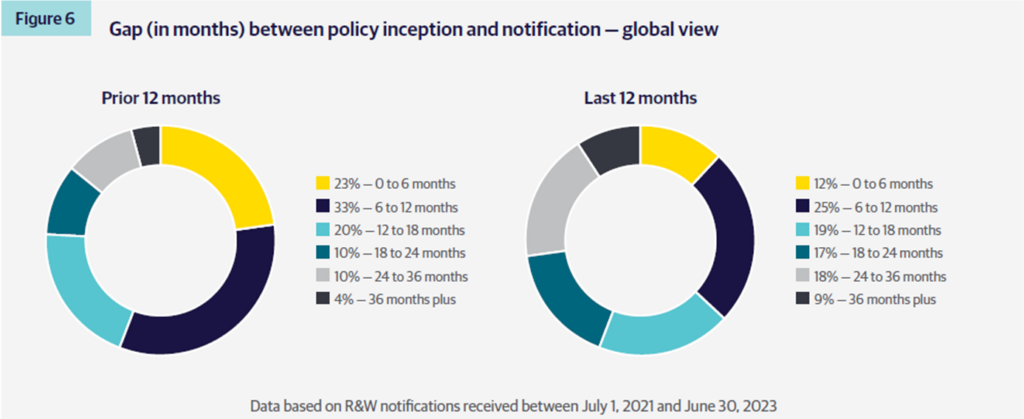

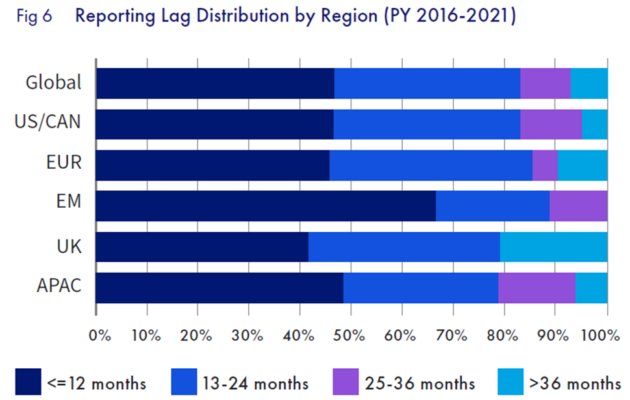

- Later reporting is a growing trend, with 44% of claims now being reported after 18 months post-close. This trend underscores the value of RWI, which provides more lenient claim reporting provisions vs. uninsured deals.

Claim Distribution

- Claim denials are rare, according to Euclid. Since 2016, only 3% of claims have been denied and only .5% have resulted in arbitration or litigation.

- Euclid reports 70% of claims are closed without payment. Digging deeper, the reasons claims close without payment are because they are below the retention point or attachment point on excess policies, or the buyer chooses to not pursue or withdraws the claim.

- With retentions dropping significantly in 2023, we expect the number of claims below the retention will decline precipitously in 2024 and 2025.

- Though counterintuitive, claims for breach of Financial Statement reps on audited target companies are received at a higher rate than unaudited target companies. Euclid reports that 84% of financial statement breach claims involve target companies with audited financials, and 90% of total paid losses come from deals with audits.

- The expectations of claims due to COVID never materialized outside of a small percentage of obsolete inventory related claims.

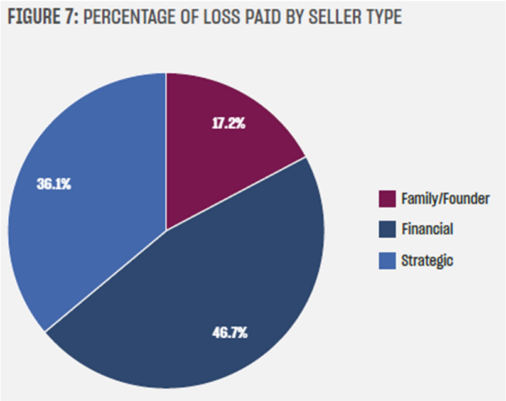

- Contrary to original belief, the data suggests that founder-owned targets do not pose any more threat for a breach than do deals with a corporate parent of sponsor seller.

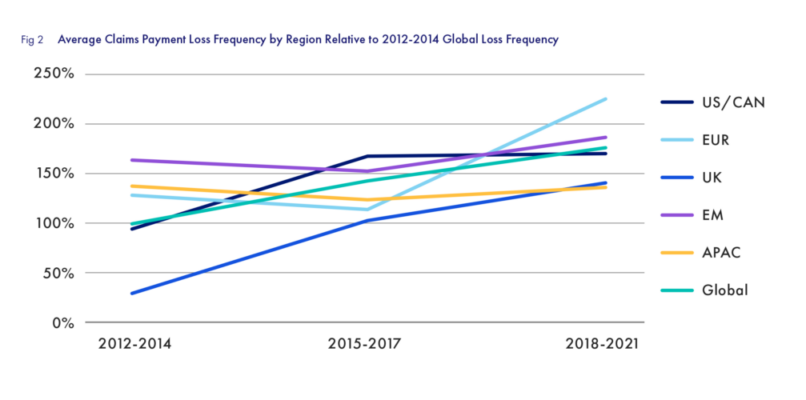

Claim Frequency

- AIG and Euclid report claim frequency remaining stable at approximately 20% of RWI policies written through 2021.

- In contrast, Liberty reports an increase in frequency for the policies written in 2021, and a significant, 38% increase in claims for policies written in 2022.

- The increase is a result of the heightened M&A activity of late 2020 – early 2022. However, that trend has subsided, and is expected to continue to subside further in 2024 commensurate with the market slowdown in mid 2022 – 2023.

- AIG reports while their claim notification percentages have remained stable, the percentage of those claim notifications that actually resulted in a loss payment has been increasing.

- This trend of higher percentage of loss payments per claim is expected to continue due to the significant decrease in retention level for policies written in 2023.

- Claims for breaches of Financial Statement and Material Contracts continue to be a driver of claim frequency (as well as claim severity).

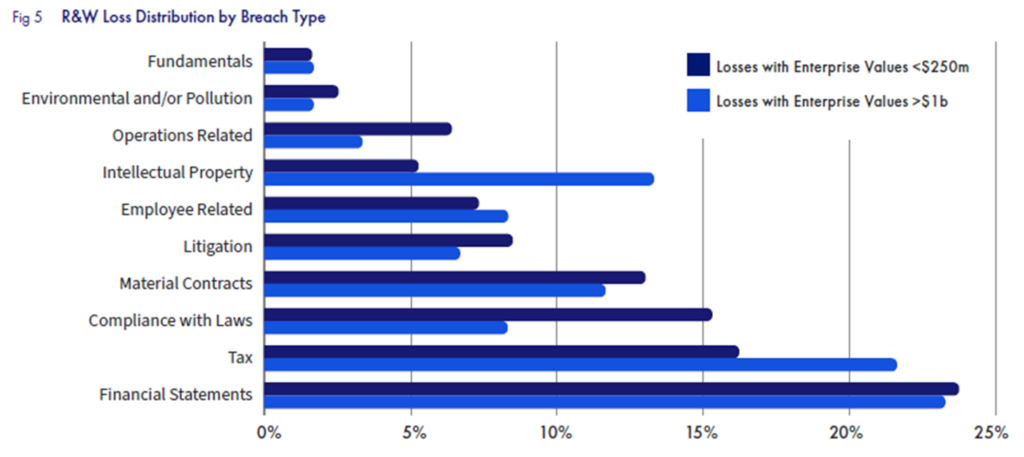

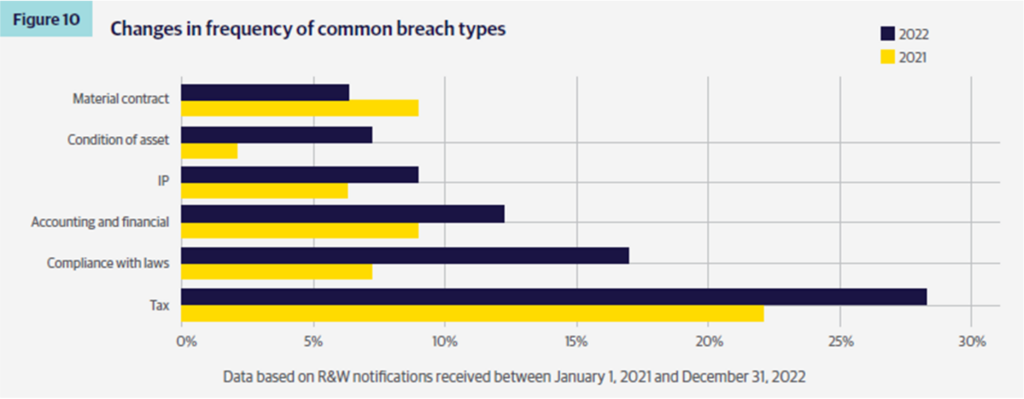

Breach Type

- Financial Statements, Tax, Customer Contracts, Compliance with Laws, and Employee-Related claims continue to be the most common areas of claim notifications.

- Those same areas are consistently at the top when it comes to actual losses paid as well vs. just notification counts.

- Claim frequency and severity for breaches of Financial Statement reps is consistent across both the high and low end of the market.

- According to Liberty, breach claims for Compliance with Laws and Tax have increased significantly over the last 12 months.

- Liberty is reporting Compliance with Laws breach claims are up to 17% vs. 7% the year prior. These claims are most common on U.S. deals, and often involve a 3rd party claim. False Advertising, Product Liability, and Data Privacy Non-Compliance (BIPA) are the common areas of allegation.

- Liberty is reporting an increase in Tax breach claims from 22% up to 28%. The increase in tax notifications was expected due to local and national governments looking to substantially increase tax revenues in order to fund COVID-related expenditures. Additionally, a higher percentage of tax claims stem from an adverse ruling vs. an audit notice, indicating tax authorities have become more aggressive. If continued, this trend will lead to greater scrutiny on underwriting tax reps, which could lead to more exclusions, and more stand-alone Tax Insurance Liability (TIL) policies issued.

- Claims for IP breaches are more prevalent in the larger deals over $250M likely due to complexity of IP portfolios, and claims for Compliance with Law breaches are seen more consistently on deals under $250M likely due to lack of robust compliance departments on the smaller targets.

- Condition of Asset reps pose significant issues for insurers as even with high quality diligence as it can be difficult or impossible understand the true condition of all assets, especially in capital/equipment heavy industries such as energy, utilities, and manufacturing. The rep being knowledge qualified protects the seller, but not the RWI insurer in many situations, and could potentially lead to insurers adjusting coverage on Condition of Assets on deals in these industries.

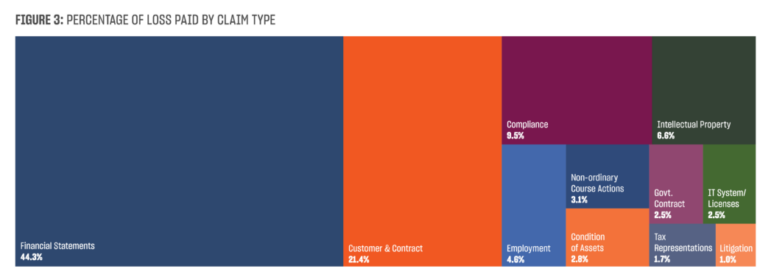

Claim Severity

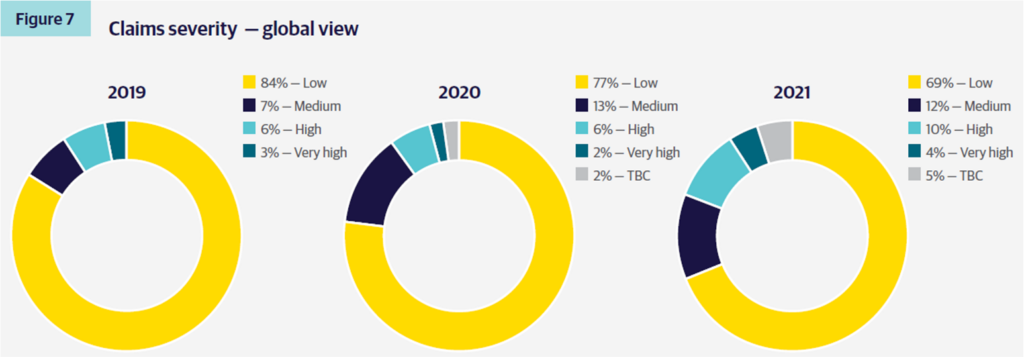

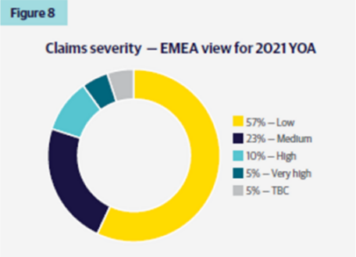

- High-severity and medium-severity claims are on the rise. High-severity is defined as over $10M in loss payment, and medium-severity is defined at claims between $1M – $10M.

- Severity claims only make up between 15-20% of total claim counts, but are responsible for more than 50% of total loss payments per year.

- Overall, high and medium-severity claims now account for 26% of claim counts, and have seen a steady increase over the recent years.

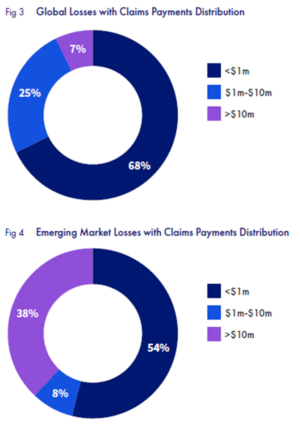

- A new trend emerging is more severe claims coming from emerging market deals. Both AIG and Liberty report 38% of claims from emerging market deals fall into the high-severity category, vs. 7% high-severity on a global basis. Whatever the cause, this trend is not expected to continue.

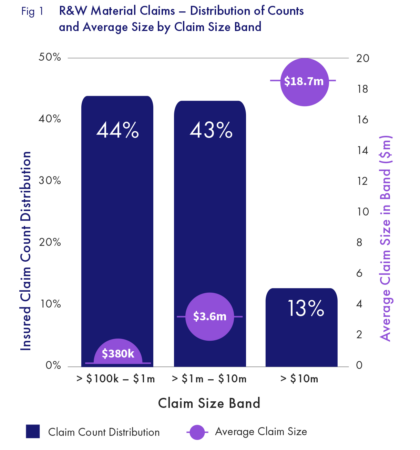

- Average claim amounts for the high, medium, and low severe categories has remained consistent. AIG reports a $18.7M average for high-severity claims, a $3.6M average for medium-severity claims, and a $380K average for low-severity.

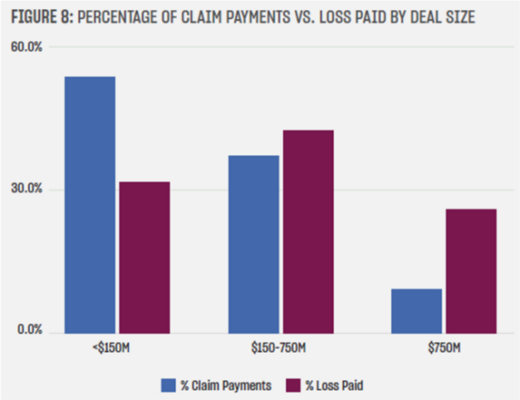

- Claims from larger deals are typically responsible for a disproportionate percentage of total losses paid. Euclid reports that claim payments from transactions with targets above $750M make up 26% of all losses paid, despite making up only 10% of claim count.

- Financial Statements and Customer Contract breaches are the two main drivers for high-severity claims. This is largely due to the potential use of a multiple when valuing the claim.

- Revenue recognition, inventory, and issues stemming from carve-outs are consistently cited as the origins of claims for breaches of financial statement reps.

- Euclid reports that buyers in North American deals are 42% more likely to assert a multiple should be applied to a claim than their EMEA counterparts.

Claim Reporting

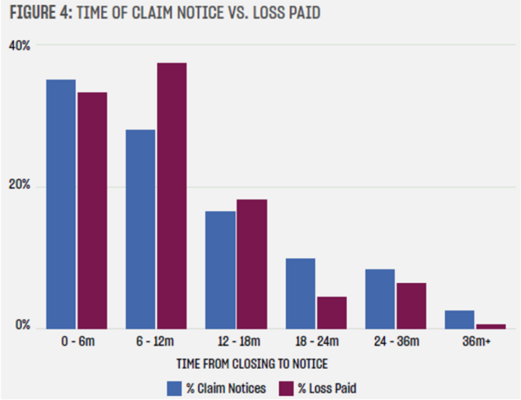

- The data is clear that the sooner a claim is made the more likely it is to result in a material claim payment.

- The majority of claims are reported within the first 12 months post-close. Liberty reports 37% of claims are reported in the first year, and AIG reports 45% on North American deals.

- There is however an emerging trend of a higher percentage of claims coming later. Liberty reports a significant jump of 44% of claims being reported post 18 months, vs. 24% the prior year.

- AIG reports 21% of UK claims are reported after 36 months, which are often tax related.

- These trends of later reporting underscore the benefit of RWI which provide a 3 – 6 year indemnity vs. generally shorter indemnity periods on uninsured deals.

- Additionally, an insured deal typically allows for more flexibility around reporting a breach claim than an uninsured deal does. Uninsured deals must follow the very strict claim reporting provisions found in agreements, and late reporting will often eliminate any chance to successfully file a breach claim. RWI policies are more flexible on reporting, which even though is not often discussed, is indeed a valuable reason to utilize RWI.

- A trend has developed for buyers and counsel to submit a laundry list of claim notifications shortly before expiry of the general rep coverage at 3 years, regardless if there is a legitimate concern or not. This approach is cautioned against as these buyers could garner reputations in the market that will limit the ability to obtain favorable terms in the marketplace on new submissions.