Reps & Warranty Insurance | Hospice, Home Care & Home Healthcare Transactions

Executive Summary

The report was prepared by the Sterling Seacrest Pritchard M&A Insurance practice group, which is lead by Tray Traynor. The purpose of the report is to inform and educate the M&A marketplace on the use of Reps & Warranty Insurance (RWI) for Hospice, Home Care, and Home Healthcare transactions.

The use of RWI for Hospice, Home Care, and Home Healthcare transactions is on the rise. Historically a difficult industry for RWI, now that Government reimbursements can be covered, there has been an increase in the demand for RWI on deals in these industries. To match the demand, there are a number of RWI specialist carriers who have an appetite for underwriting and placing coverage on M&A transactions in these industries.

Below are guidelines on the benefits of RWI to both buyer and seller, how to use RWI as a strategic tool, what diligence is required to get coverage, standard pricing, common exclusions, underwriting considerations, claim information, key differentiators of Sterling Seacrest Pritchard’s M&A practice group, and sample RWI deal documents.

What is Reps & Warranty Insurance (RWI)?

- RWI is an insurance policy utilized by M&A professionals to enhance the M&A process and provide benefits to both buyers and sellers.

- The RWI policy is intended to provide insurance coverage for the reps the seller makes in the agreement for any post-close breach of those reps, subject to underwriting and standard exclusions.

- The primary benefit for the seller is the RWI policy limit replaces the escrow holdback, which means the seller receives all of their proceeds at closing vs. just a portion and provides peace of mind there will be no clawbacks.

- The primary benefit for the buyer is RWI provides a longer period of indemnity (3-6 years v. 12-18 months). See the “benefits” section for more details on benefits to both buyer and seller.

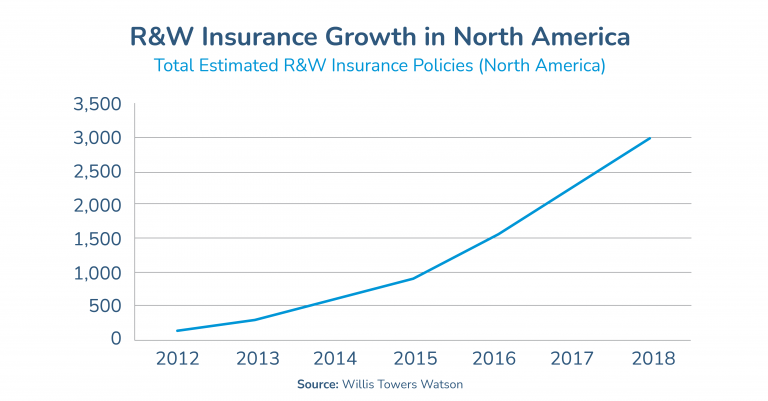

- The use of RWI in general M&A has increased by 900% since 2013 and is now used on approximately 90% of middle-market deals.

- In 2020, the percentage of RWI policies placed among all industries with strategic buyers surpassed private equity for the first time ever, a trend that is expected to continue.

- The most significant market growth happened in 2014 when M&A professionals became comfortable that carriers would pay claims, and started to see claims getting paid.

- Healthcare, in general, was slower to adopt RWI primarily because RWI didn’t initially cover Medicare/Medicaid reimbursement reps. However, that has changed and coverage for Medicare/Medicaid (and other reps initially excluded) is now available.

- Please see this article which explains why RWI for healthcare “is a must.”

RWI Benefits to Buyer & Seller

Benefits to Buyer

- By including RWI on their bids, buyers either are able to distinguish their bid, or more commonly, stay competitive against other bidders who will most likely include RWI.

- Provides indemnification protection not otherwise afforded by the Transaction Agreement.

- Extends survival periods (three or six years for general R&Ws, and six years for fundamental and tax R&Ws).

- Potentially larger amounts of coverage protection (coverage for up to 100% of the purchase price can be obtained).

- Buyer collects from a neutral third-party underwriter that is experienced in the claims payment process.

- Helps to mitigate against potential disruptions of existing relationships between a seller and buyer both during the transaction, and after if equity is rolled or mgmt. is retained.

- Expanded definitions of Loss – RWI Policy may reimburse a buyer for consequential and multiplied damages and will include “materiality scrapes.”

- Affords a smoother overall negotiation process, and less hand-wringing over each rep.

Benefits to Seller

- The primary benefit to the seller is that RWI replaces the escrow, which enables the seller to walk away from closing with either 99.5% or 100% of their proceeds vs. having it tied up in escrow.

- Seller no longer liable for breach of general reps, or any reps in the case of a “walk-away” policy

- Seller realizes the full value of sale immediately / can redistribute funds faster

- Helps facilitate the transaction if the buyer is suspect of the seller in any one area

- Mitigates disparate seller situations

Enhancing Bids via RWI

- By including RWI on your bids, you are absolutely making your bids more competitive in the seller’s eyes.

- In fact, the M&A market for most all middle-market deals has now shifted to the point that if the buyer’s bid (whether PEG or strategic) does not contain RWI, it will be seen as non-competitive

- RWI can be obtained in as little as five days, and the carriers come behind the diligence the buyer and their advisors have done vs. slowing the process down by performing their own diligence.

No-Seller Indemnity Policies & Public Deals

- Bids can be further enhanced by using a type of policy called a No-Seller Indemnity, commonly called a “walk-away” policy. With a “walk-away” policy, none of the seller’s reps survive closing, there is no escrow, and they receive 100% of sale proceeds at closing. “Walk-away” policies account for approximately 50% of the RWI policies placed annually.

- Because of the development of “walk-away” policies, RWI is now also being utilized on deals with a public company as the seller. Please see this article published by Harvard Law which further explains how RWI is being used in public company transactions.

Hospice, Home Health, & Home Healthcare RWI Marketplace Overview

Market Summary

- Hospice, Home Health, and Home Healthcare are some of the most challenging industries for RWI underwriting and policy placement.

- The historical challenges stem from this being a highly regulated industry with burdensome compliance laws, a high percentage of Government reimbursement revenue, sometimes lack of requisite diligence performed by buyers, non-professionalized sellers, and high claim frequency and severity for RWI policies placed.

- However, despite the challenges, there has been tremendous growth in RWI activity for these industries. The growth is primarily due to carriers now being able to cover Government reimbursement, the sheer number of deals in this sector, and the increase in how many of these deals are requesting RWI coverage.

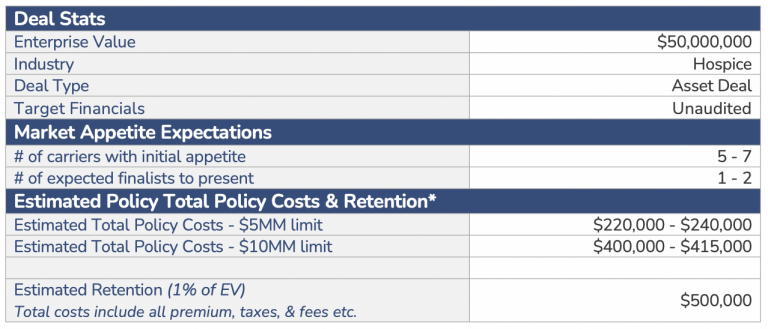

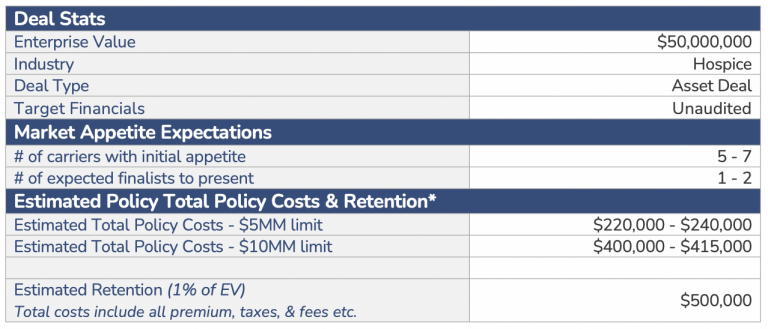

- Of the twenty-four (24) domestic-focused RWI markets, there are roughly 5 – 7 carriers who have an appetite to underwrite and put out terms on transactions in these industries.

- Each of the 5 – 7 carriers have a slightly different underwriting appetite, and it’s largely deal-specific / a case-by-case basis whether each one will produce terms on any one deal.

- There are a number of repeat strategic and PE buyers in these industries who are consistently taking out RWI policies on their transactions in order to enhance their bids. They also benefit from getting preferential treatment from RWI carriers based on volume.

- Any deal with EV over ~$15MM — $20MM in these industries can be considered large enough for RWI coverage.

- Hospice, Home Care, and Home Healthcare targets in TX and FL are generally not as attractive for RWI coverage all else equal due to the amount of fraud traditionally found in those states. However, RWI is still generally available in both TX and FL for these industries.

Policy Costs & Retention

- Total policy costs typically range between .30 – .40 basis of the total purchase price.

- Please click here for a breakdown of total cost examples.

- Average rates for healthcare deals are higher than most other industries, and are generally between 3-4% of the limit (limit, not purchase price); with 3.3% –3.5% being the median.

- The most common limit is 10% of EV for deals between $100MM and $1 billion. On smaller deals under $50MM, the average limit ranges between 15-20% of EV, and for the largest deals the average limit is under 8%.

- The standard retention is 1% of EV. On larger deals above $250-$400MM the retention can drop between .75% – .90%.

- Some carriers will bifurcate the retention, and add specific and higher retention just for billing & coding vs. excluding billing & coding outright.

- One carrier will apply a 2% retention on any deal under $100MM EV for hospice/ and home healthcare deals.

Common Exclusions & Heightened Areas of Underwriting

- In addition to the standard RWI policy exclusions that are automatically included in every RWI policy such as disclosed items, asbestos, and forward-looking statements, the common industry-specific exclusions you can expect are:

- Medical malpractice / E&O / Bodily Injury & Death

- Abuse or mistreatment of patients

- COVID-19 – broad exclusion

- The common areas of heightened concerns are as follows. Whether or not these areas turn into exclusions largely depends on the fulsomeness of diligence and underwriting.

- Collectability of accounts / patient receivables (often excluded)

- Billing & Coding

- Claims for Hospice Cap Liabilities (often excluded)

- Healthcare regulatory/compliance with laws

- Labor & Employment / Wage & Hour / Employee Classification / FLSA

- Corporate Practice of Medicine •Data Security/Privacy

Diligence Guidance

- While all carriers prefer to see 3rd party diligence, most carriers who have an appetite for this sector are open to underwriting some internal diligence, as often seen with strategics.

- For internal diligence to be satisfactory, the summary analysis must be memorialized in a written/deliverable format, the buyer must have the requisite expertise in the sector, and the thoroughness of the diligence must be essentially equal to a 3rd party report.

- Ideal diligence would consist of the following and would ensure robust coverage:

- 3rd party QOE, inclusive of:

- Cash proofs of revenue and expense (when financials are unaudited)

- Billing cash waterfall to confirm the quality of A/R

- Validation of Medicare cap figures

- 3rd party tax diligence (Big 4 preferred)

- 3rd party billing & coding audit

- Most carriers accept all the big providers, however, one top carrier will not accept work from McBee.

- Marwood is generally the most recommended provider

- 3rd party healthcare regulatory diligence report from the respected healthcare law firm

- 3rd party legal diligence for standard M&A legal issues from respected M&A law firm

- 3rd party QOE, inclusive of:

- It is not required to have all of the above diligence in place and performed by 3rd parties to ensure robust coverage, but the closer it is to this ideal, the better the terms will be.

- Most carriers will require the billing & coding audit be from a 3rd party. However, there are 1-2 carriers who would accept an internal billing & coding audit, with the requirement that the buyer is one who consistently runs their own internal audits and applies the same process to diligence the target.

- If the target does not have audited financials most carriers will require a 3rd party QOE to cover financial reps. However, there are 1-2 markets that are the exception and will accept internal financial diligence on an unaudited target if the diligence is thoroughly summarized.

RWI Pricing & Coverage Expectations Project Sample

- Anticipated Exclusions

- Standard RWI exclusions such as networking capital true-ups, disclosed liabilities, forward-looking statements, underfunded benefit plans, breach of covenant, etc.

- COVID-19 Broad Exclusion

- Medical malpractice / E&O / Bodily Injury & Death

- Abuse or mistreatment of patients

- Anticipated Areas of Focused Underwriting

- Collectability of accounts / patient receivables

- Healthcare regulatory/compliance with laws

- Billing & Coding

- Hospice Cap Liabilities

- Labor & Employment / Wage & Hour / Employee Classification / FLSA

- Corporate Practice of Medicine

- Data Security/Privacy

RWI Claims

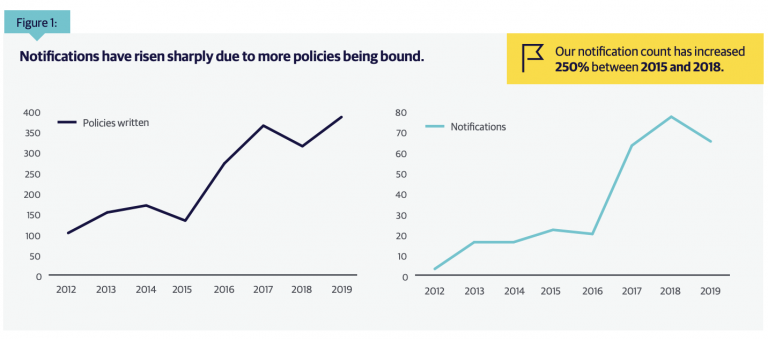

RWI carriers have a well-defined claims process that has established a strong track record of paying claims. RWI would not have grown in use and replaced the traditional forms for indemnity if claims were not consistently getting paid.

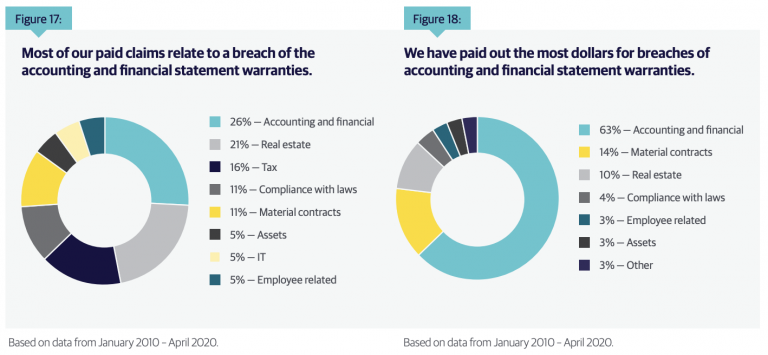

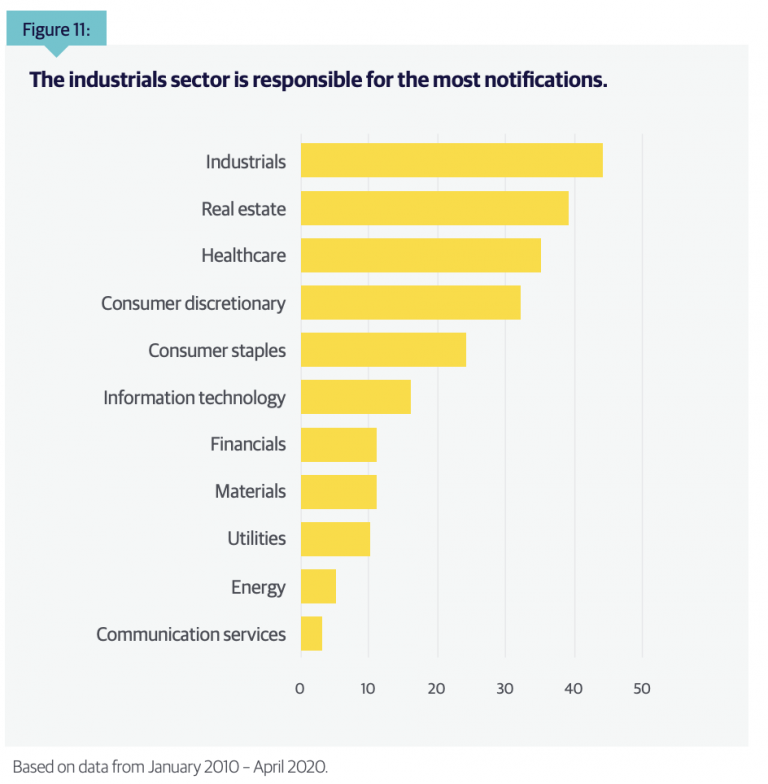

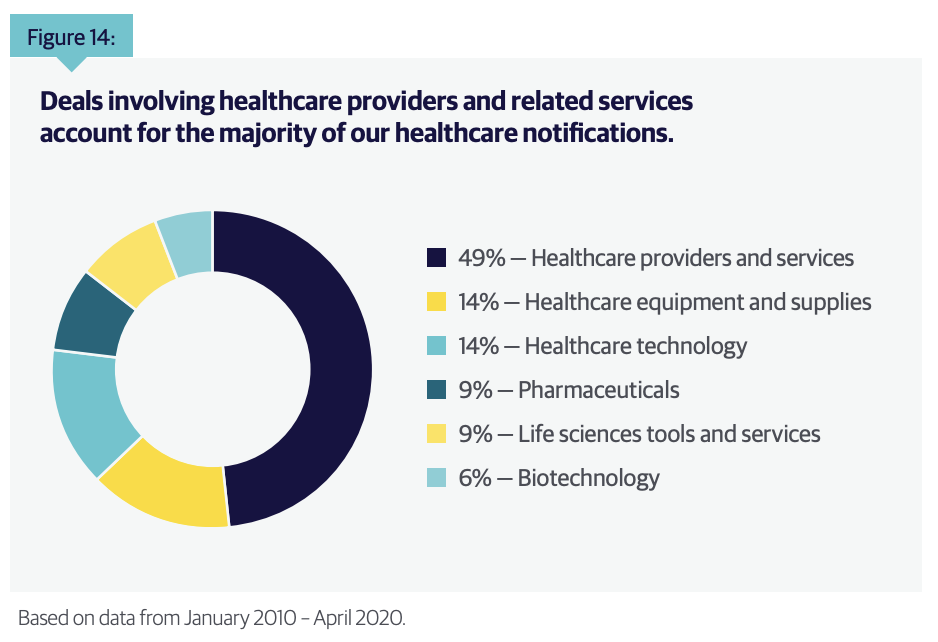

Source: Liberty Mutual Global Transaction Solutions 2020 Claims Study

Most carriers report they receive a claim notification on roughly 20% of RWI policies placed.

Healthcare-related industry claims are consistently in the Top 3 of most frequent claims.

Healthcare providers account for almost half of the industry’s healthcare claims.

Sterling Seacrest Pritchard Key Differentiators

Overview

- Sterling Seacrest Pritchard (SSP) is the single largest, privately-owned commercial insurance brokerage in the Southeastern United States, and is a Top 1% brokerage nationwide.

- Recognizing early that RWI would significantly grow, SSP was one of the first commercial insurance brokerages anywhere in the country to specialize in RWI, and other transactional insurance products.

- Lead by Tray Traynor, SSP has a dedicated team of M&A and insurance professionals who are involved in the RWI process from start to finish of each deal/RWI policy placement.

- SSP has worked on deals from $10MM to $2 billion. Our portfolio of clients includes Fortune 100 companies, as well as some of the largest Private Equity groups in the world.

- Our model is unique and allows us to consistently win business when competing against publicly traded brokers.

- The four areas that consistently separate us from our competition are:

- Pricing

- Technology

- Responsiveness & Attentiveness

- Commercial insurance expertise in the Hospice & Home Healthcare sector & diligence capabilities

Each one of these key differentiators is addressed on subsequent pages

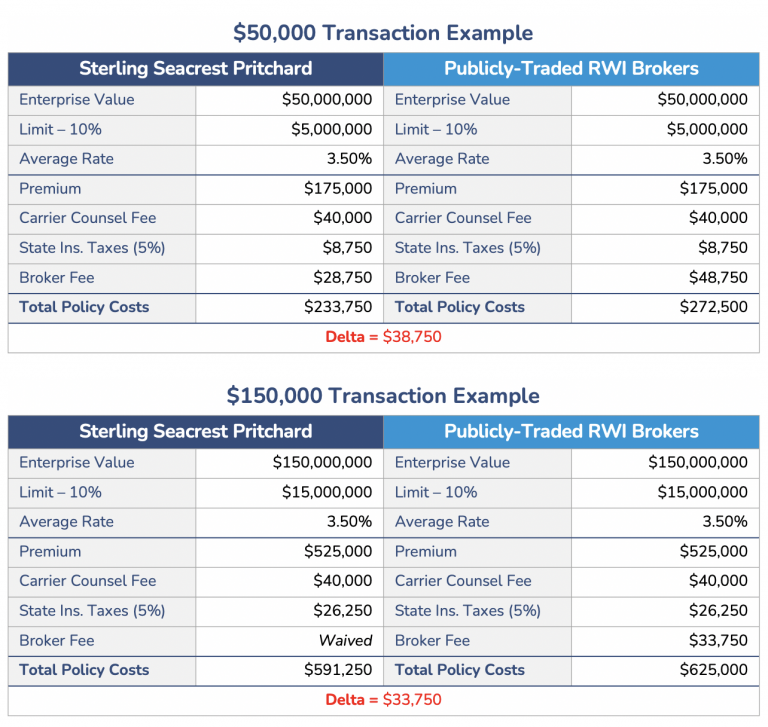

Pricing

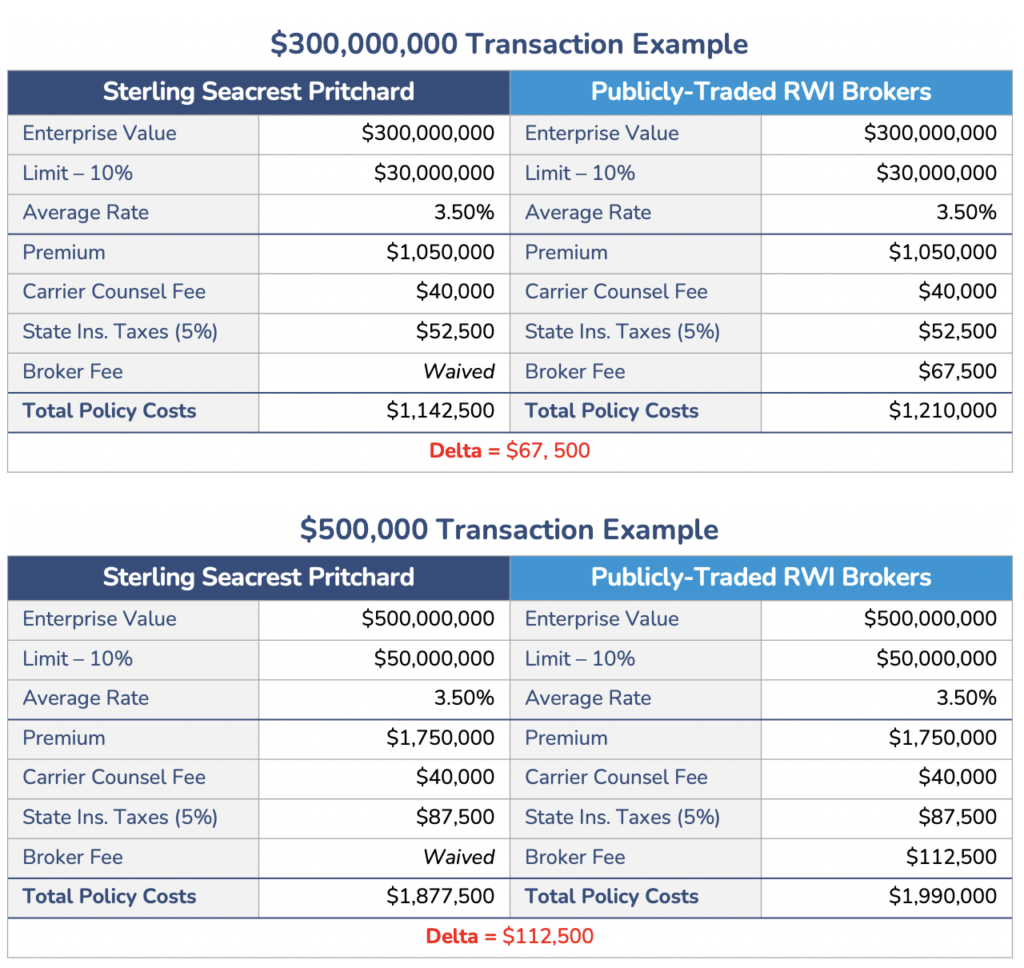

- SSP’s pricing model is different from the publicly traded brokers, and is always more cost-efficient for our clients.

- Please see pricing and cost comparison examples below.

- Generally speaking, the larger the deal the bigger the delta in costs between SSP and the publicly traded brokers.

- The delta in per-deal costs between SSP and the publicly traded competitors is especially multiplied and impactful when spread over multiple transactions.

Technology

- Sterling Seacrest Pritchard (SSP) is the first and only representations and warranties insurance (RWI) broker specialist in the United States to officially license The RW Exchange (RWX) platform, originally developed by M&A Insurance Solutions in order to enhance the RWI user experience for clients and M&A Partners alike.

- RWX was specifically designed to deliver speed and execution through total control and transparency to all parties involved in the RWI policy placement process. The platform is a cloud-based project management tool and shared-site which acts as an RWI tracker for the approximately 25 steps across the six primary stages of the RWI placement process (see graphics on the next two pages for illustrations).

- RWX also doubles as a functional virtual data room for the exchange of documents relevant to RWI policy placement. The benefits of RWX to clients and other stakeholders include unprecedented transparency into the RWI process, enhanced collaboration/control via the shared platform, instant access to key documents as well as formal data storage/compliance.

- Access to RWX is only available via Sterling Seacrest Pritchard and M&A Insurance Solutions.

- Simply put, RWX is the future of RWI and we are very pleased to be on the cutting edge of the industry.

Advantages to Using RWX:

- Control: All parties proactively triage the numerous steps by providing comments and documents directly to RWX without waiting on the broker to provide direction

- Transparency: Visibility into each step of the process for all necessary deliverables, communication, and requests for information so that no questions are left to the imagination

- Collaboration: One central location and a single source of truth for all designated parties as a roadmap from start to finish

- Accountability: Removes any question as to when and what users submitted, making each party directly accountable for their individual participation

- Communication: Sends real-time communications to the appropriate clients, brokers, and insurers when comments and/or documents are uploaded

- Security: Powered by Amazon Web Services (AWS), RWX’s native-cloud technology mitigates risk by keeping data secure, confidential, and yet accessible 24-7

Boutique Service Model

- SSP’s service is boutique in nature. Our goal is not to churn out 500 policies a year, but rather to provide a higher level of attentiveness and responsiveness to each and every deal.

- Our seasoned team lead is intimately involved in the details of every deal. Our model does not involve handing off deals to entry-level analysts at any point in the process.

- This service model resonates with clients and advisors and is one of the primary reasons why Fortune 100 companies, as well as some of the largest Private Equity groups in the world, continue to choose us for RWI.

- Multiple references are available upon request

Hospice & Home Healthcare Commercial Insurance Insurance Expertise

- SSP believes the best way to service clients is to be an expert in a few select areas. We, therefore, have teams dedicated to only a certain number of verticals, foregoing all others.

- Healthcare has always been SSP’s primary niche vertical.

- In addition to RWI, Tray Traynor is one of the subject matter experts on commercial insurance specific to the healthcare sub-sector of Hospice, Home Care, & Home Healthcare.

- Having the expertise of both commercial insurance and RWI/M&A for this specific industry with your main point of contact is an extremely rare and valuable combination.

- The two primary benefits of this combined expertise to clients are 1) the capability to overcome RWI exclusions that pop up during underwriting due to higher knowledge and understanding of the target operations, and 2) performance of commercial insurance diligence reports keeping in mind the perspectives of both an RWI underwriter and the buyer, who will view the report for their own separate purposes.